Turning 75k into 487k with a mobile home.

This is a case study on one of my early mobile home deals that I closed on. Mobile homes as an asset class are not typically viewed as a favorable investment, this breakdown will show otherwise.

Now, I know how the title of this post may throw up the initial question, “How did this guy flip a mobile home from $75,000 to $487,000.” Most people who jump into the real estate investment start off flipping houses or renting them out. There are a number of other strategies to execute in this space. For this specific deal, I did not “flip” this home in a traditional sense but utilized a strategy called “owner financing” (sometimes called seller carry).

A couple things to note on this case study. This deal was a anomaly, the numbers shown are not typical of your average owner finance deal. I was able to purchase the underlying property at an extremely great discount. I seller financed this deal instead of flipping it.

Finding The Deal

This property was found off of a cold calling campaign. The campaign specifically targeted properties that were in and out of foreclosure (often categorized as a pre-foreclosure) located in the San Antonio area.

This property was scheduled to hit the auction block the first Monday after New Year’s Day. In the state of Texas, all foreclosure auctions in every county happen on the first Tuesday of every month on each county’s courthouse steps. There is nothing stopping anyone from attempting to purchase it prior to the auction directly from the owner.

In this case we were able to contact the owner and work out a deal to purchase the property. I utilized my own cash to close this deal. We closed the Friday before the auction, the day before New Years.

Acquisition and Closing

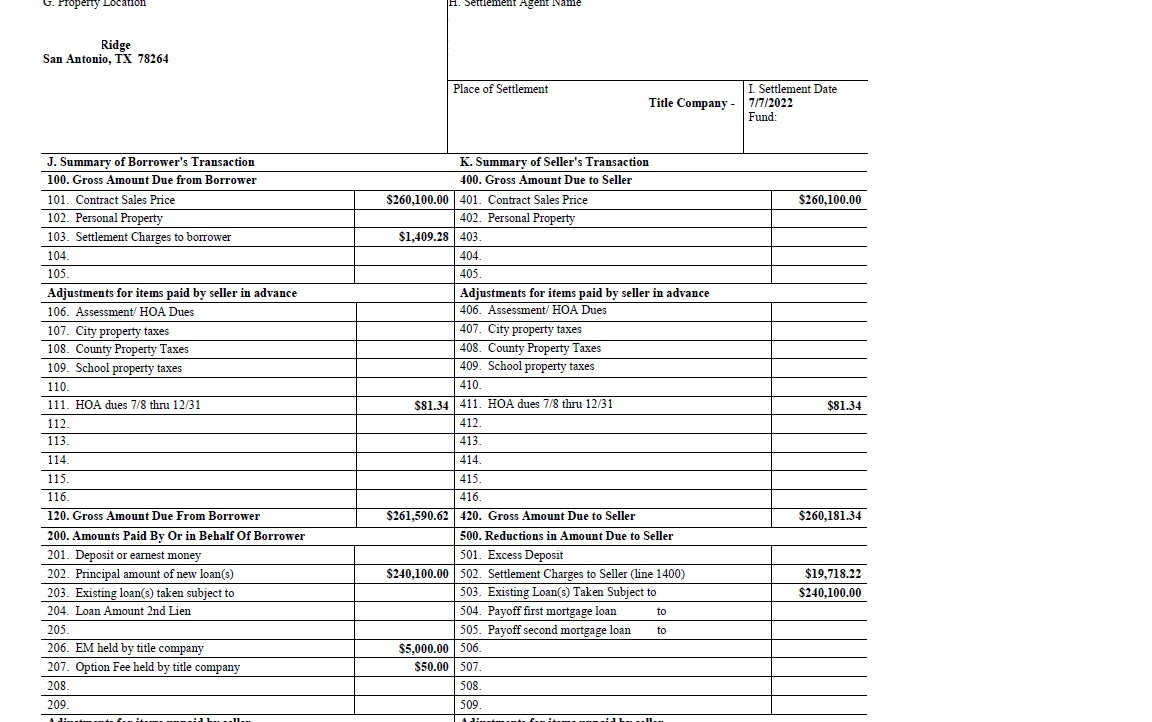

Since this property had a mobile home, I had to both purchase the land and the mobile home. Sometimes the mobile home isn’t “entitled” which means being attached to the land. Not just psychically attached to the property but also in a legal sense, having title incorporated as a matter of public record. In this case, the loan that the bank was foreclosing on was secured against the land, it did not include the mobile home. We purchased the land for $47,500 (market value at the time was 85k-115k). We made a separate agreement to purchase the mobile home for $8,000.00 outside of closing as there were title issues.

I had to clear title for the mobile home since the current owner purchased from a gentlemen who was now deceased, who also purchased it from someone that was deceased. The current owner never registered the mobile home properly with the state. Needless to say, it took a minute to clean up title before we could “entitle” the mobile home to the land to be able to resell it properly.

Entitling a mobile home requires a few things; showing clear ownership of the mobile home an d paying off any existing tax liens as the mobile home is considered “chattel” property like a car. When entitling a mobile home with the state, you are essentially surrendering the mobile home title to the state of Texas to then combine it with the land. At this point, you submit all documentation to the TDHCA (Texas Department of Housing and Community Affairs) who will then register it in their system. Once all is said in done, you legally have a mobile home that’s considered “real property” which is now much easier to secure financing against.

Rehab and the Resale

Most of the rehab on the property was clean up. We spent about $18,000 or so in dumpsters, labor for clean up, yard touch up and plumbing/AC repair.

Took a while to get this properly on the market. It was listed on the MLS, took a couple of buyers falling in and out of contract before we landed on a couple who wanted to owner finance this property.

When owner financing a deal, you become the bank. It is up to me as the owner to fully underwrite the potential buyers. This includes, pulling credit, reviewing tax returns, asset statements, paystubs, rental history, calculating debt to income ratios, etc… Doing everything a normal bank would do when lending. I am free to underwrite buyers with below average credit or self employed borrowers who declare less income. Being stringent on underwriting not only helps you mitigate potential loss (having to foreclosure), but also allows you to potentially sell the underlying mortgage to another investor (more on that later).

All in all we sold the property for $260,100 with $20,000 down. The loan balance was $240,100 at 5.074% interest for 30 years which brings the principal and interest payment to exactly $1,300 per month. As we are the bank, we are not responsible for taxes or insurance. $1,300 per month is what I am receiving for the next 30 years.

The Hard Figures - Net Profit

Here is the full breakdown of it all. Calculating all payments made over the next 30 years, plus the down payment received, subtracting out the closing costs and initial investment amount, the (potential) net profit comes out to around $413,000.00.

$487,729.23 Gross Profit - $74,500 Initial Investment Amount + $12,000 in Closing Costs = $413,229.23

Something else to consider is the ROI for this asset type. The interest rate of the note/mortgage I created is 5% but my true return is actually closer to 20% (yield). My cost basis is 70k or so, then I also received 20k (down payment) back the day I resold it, factoring those numbers into my payments per month gives me a higher return than the actual note/mortgage interest rate. For the next 30 years, I’m making 20% on my money as a rough estimate. My money is secured as a first lien against the property, and once again being the bank, I am not responsible for the repairs, insurance, and taxes of the property.

The biggest drawback with going with this strategy is the fact that your money is tied up for a considerable amount of time unless the new owner of the property sells or refinances within a couple years. There is another financial instrument that you can utilize to recapture a large portion of your investment on a note like this.

Flipping Notes and Selling a Partial

When originating notes/loans, you can actually flip them to another investor. It’s done all the time. If you have ever closed on a house with a traditional mortgage, you will have received mail stating your loan is no longer with ABC Bank but with XYZ Mortgage Company. Your loan was sold and transferred to another servicing company and/or bank.

You are able to do this same strategy on a much smaller scale. I could list this note of $240,100 for sale and attempt to sell it at a discount. The discount is based a variety of factors from the actual asset itself (property), the borrowers overall financial picture, and then how long the notes been seasoned. I would take a lump sum for a discount off the entire price of the loan.

Another advanced strategy you can employ is selling a partial. A partial is selling a portion of the note for a upfront cash discount.

After 18 months of seasoning (owning a note while receiving payments), I listed this for sale. An investor reached out and was interested in making an offer for a partial. He wanted to make a 12.5% return on his money over 6 years. Since the note is at 5%, I would have to take a discount to make it work.

To find the amount of what the discount would be, I used a financial calculator. As you can see above, for the buyer to achieve his 12.5% return for 6 years (72 months), I would be taking a slight haircut off my payments.

$1,300 (Principal and Interest) x 72 Months = $93,600.

$93,600 (total money received over 72 months) - $65,619.29 (partial offer) = $27,980.71. Let’s just round up and say $28,000.

For the next 6 years, I will not be receiving my $1,300 per month but instead a one time cash sum of $65,619.29. The investor will be receiving those payments instead. After the 72 months have passed, the loan will revert back to me.

Is this a good deal? Depends on how you look at it. I now have money to invest again. Is it worth the discount I took? In my situation I do believe so, I can put that capital back to use and do it again.

There is one more thing to consider when doing a partial. Due to how a mortgage amortizes early on, the payments I forgo is mostly interest. Why is that important? See the graph below.

The orange (partial) is what I sold, the blue (original loan) is the remaining payments owed to me. Since I sold the front of the loan, when I receive my loan back to me after 6 years, a large part of the principal is still there. Specifically about $216,000. This is where the financial magic happens.

My original loan balance is $240,100. I sold $93,600 of payments. When I receive my loan back to me after 6 years, my balance is about $216,000. I only lose $34,000 of actual principal.

Why is this so important? The average American moves homes every 12.3 years. There is a large probability within that 12 year time frame of me getting my full loan balance paid since the home owner will sell the property within that time frame. Freddie Mac has reported that when factoring in refinances into that equation, the average loan balance gets paid back in about 6.5 years. Within that 6-12 year window, there is a high chance of getting this loan paid back in full.

There are other cool strategies you can combine with notes and partials, like utilizing a self directed IRA to fund these deals or a hypothecation, securing a line of credit against a bundle of notes.

I’ll be diving into another deal in the next post where I purchased a mobile home off the courthouse steps and how to underwrite these deals ahead of time.

A Dose of AI

Key Words - 2008 Financial Crisis Artsy