Texas Tuesday - Real Estate Foreclosure Auctions - Part 2

What happens on the auction day, purchasing a home on the steps, and the net profit all detailed below.

The final list of properties is set, and now is the time to snag cashiers checks the day before. The trustee will only accept cash or cashiers checks, nothing else. I’ve seen people roll in with wads of cash which probably isn’t the most secure thing to do.

The cashiers checks will have to be in a combination that allows the buyer to make any sort of bid amount possible. In my case, it would be at least one $80k, a $30k, two $5ks and some $1k checks. The checks will have to be made out to the owner of the account. This allows the person to just endorse the back of the check to whoever the trustee is to make the purchase.

Texas Tuesday - Day Of

Checks in hand, it’s now showing up to the county steps early in the morning. It’s worth bringing a chair, water and a book to read. Most of the day is spent waiting around.

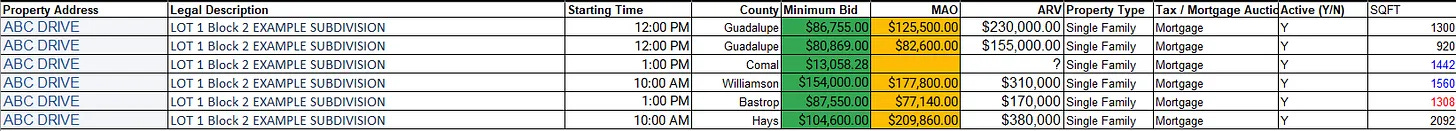

As you can see in the excel sheet, each notice of foreclosure will post not just the date, but the window in which the property will be auctioned off. The window is typically 3 hours. For example if a starting time is 12:00pm, the trustee can show up and start anywhere between noon and 3pm. There can be multiple properties within that window, and multiple auctions can be happening at the same time. Having the legal description on hand will help differentiate the property going up for sale as most trustees will run off that instead of the common address.

On top of all of this, the foreclosure can be pulled on the day of the sale. It happens quite a bit, waiting for a property to be sold for 3 hours and no one shows.

In the case of this property, the actual auction was handled by auction.com. It’s a little more organized as they have employees at the county steps wearing gear with their logos and have up to date information of when their properties are pulled or not.

The auction officially starts as the trustee starts to pull out their notes or iPad and start reading a lot of boiler plate disclosures, the legal description or the property address and then the opening bid amount. Everyone typically gathers around the trustee to listen in. The bidding starts, and typically goes up in amounts of $1,000.00, if there is a bidding war they can start going up by $5k or even $10k at a time. There is a reserve that must be hit for the property to sell, it’ll only be known once the final bid is in.

It’s just as you would imagine, people raising their hand, the trustee stating the current amount and if anyone is willing to go higher. Once a price is locked in, it’s “going once, going twice” sold to “X” bidder, forever hold your peace.

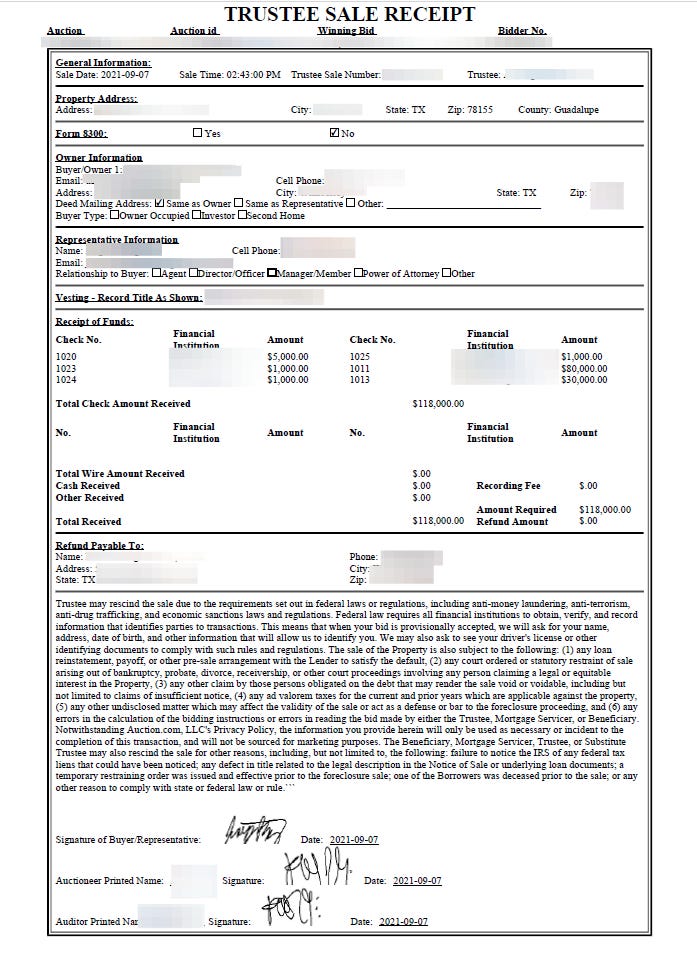

With this property, we did go over our MAO (max allowable offer) as we were competing with another investor who was bidding via proxy (over the phone). In the end we did secure the winning bid at $118k. Right after winning the bid, you are required to step aside with the trustee and write over the cashier’s checks. They typically give you a receipt of some sort, and I’ve attached the one I got below.

Once the monies have been receipted, it’s now another waiting game. The trustee mailed me the deed for the property about 3 weeks later. For about 3 weeks or so, I could not legally show that I was the owner of this property. This meant I could not put utilities in my name, insurance and/or risk walking the property with no proof to show ownership if asked by police or neighbors.

A Little Luck and A Lot of Profit

Wasting no time, as soon as we confirmed our winning bid we went over to the property that same day and drilled out the locks, and re-keyed the doors. Pictures of the day we walked it are below.

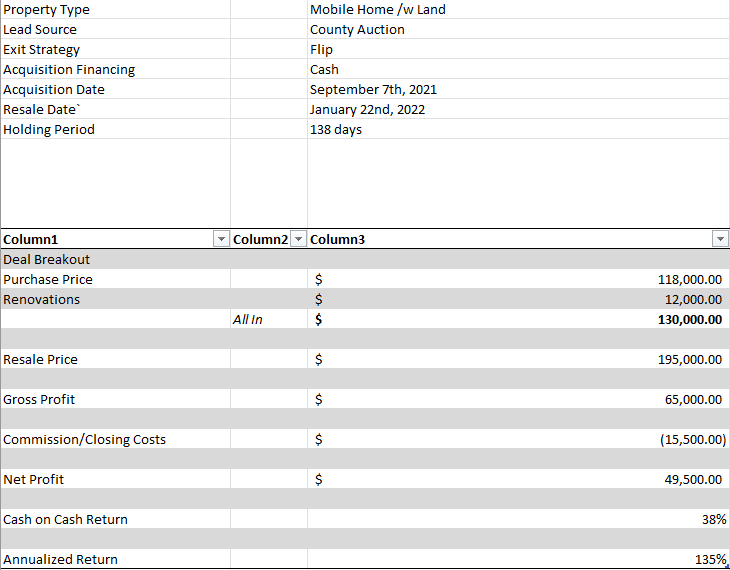

Expecting a trashed out interior, we lucked out and got a home that hardly needed any work except a little clean up. Not to mention, no tenants or squatters at all. The rehab only consisted of a power wash, cutting the lawn, replacing a few 2x4s, trash out and clean up. The turn around on this project was extremely quick.

Listed the property and quickly received offers for the home. One of the hurdles for us to sell this property was the holding rule for FHA loans. FHA underwriting may require flipped properties to be held for at least 90 days before closing a loan. Since it was such a fast turn around, we accepted a contract knowing that we would probably have to rewrite it once we hit the 91st day. During the waiting period, the buyer could complete their inspections. Lender asked us for a couple easy repairs but all in all, a pretty easy transaction. Final break out below.

For the next case study, I’ll detail out a standard SFR flip bought off market utilizing hard money. Flipping a property with only $6,500!

A Dose of AI

Prompt - Interest Rates, The Fed, Realism