Texas Tuesday - Real Estate Foreclosure Auctions - Part 1

This is another case study on a flip which I purchased at the foreclosure auction. Part 1 is about everything that goes into buying at the auction steps, Part 2 is all about the actual numbers.

Texas Tuesday happens at on the first Tuesday of every month in each respective county. Foreclosures are auctioned off on the literal courthouse steps. You may have seen TV shows where they show prospective buyers in front of the foreclosed home where the auction happens, in Texas that’s not the case. In California, auctions happen daily in front of the property itself.

This type of auction is specific to mortgages from banks, private parties and HOAs. There is another type of auction which is the tax sale auction. This type of sale happens on the same day and can be riskier than your standard foreclosure sale. It has to do with delinquent property taxes and I’ll do a write up on these types of auction types later. A big reason tax sales are riskier is the original owner of the property has the legal right to buy it back from you (right of redemption period) as well as the fact that you are only buying the tax lien, not the underlying mortgage. So you could purchase a home for $10,000 that is worth $150,000. Not knowing that there is a delinquent mortgage for $175,000 which doesn’t get wiped out at the sale.

Building a list and checking it twice

So where are all these foreclosures? Is there some list posted somewhere that shows these homes going to auction?

All homes that go to the auction block must have public notice from the note holder (typically the bank) giving the home owner time to bring the loan current. A home owner can be one payment behind or 10 years behind, it’s up to the loan holder to start the process of foreclosure. There is no set time after a borrower misses their payment that the clock starts. The clock starts whenever the note holder decides it’s time to foreclose and gets their attorney involved.

Since these notices are a matter of public record, you can search in each respective county clerk’s system (if they have an online search) and start working up a list of these properties.

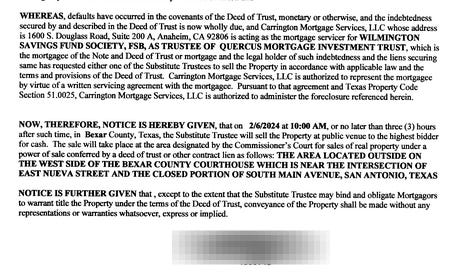

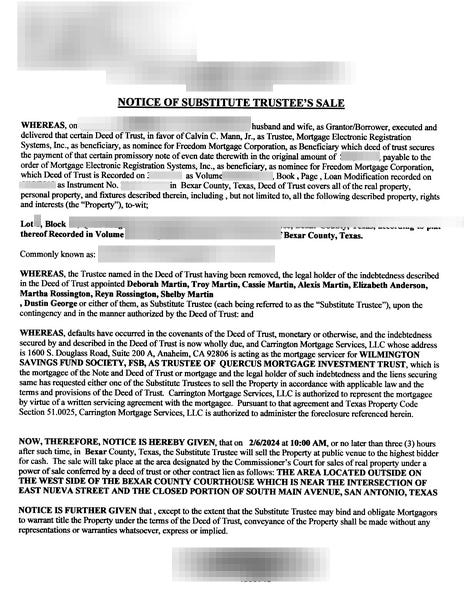

This is pulled from Bexar County (San Antonio). I’ve sanitized the personal information but the key data points are listed in here. The date of the original loan, legal description of the property, sometimes they give the common address, the trustees, the bank info, the original loan amount, and the date and time the foreclosure happens.

There is a lot of data to keep track of and a lot of public documents to go through. You can either do it yourself or utilize a third party service that will organize and provide an excel file showing all the pertinent information of each foreclosure every month. Bigger counties sometimes even aggregate the data for free like Bexar County. https://maps.bexar.org/foreclosures/

At this point, most new investors are thinking, can’t I just reach out to these owners ahead of time and try to buy it before it hits the auction? Absolutely, my previous case study, I did just that. This list isn’t that hard to pull and most investors are already cold calling, mailing and door knocking these leads the moment they see the notice is posted. It’s a competitive marketing list to snag deals from, but there is opportunity to be had.

However you get your list together, you put all the properties for the next month into a big list and the next step is underwriting these properties. The first thing you have to do is weed out the properties that are underwater or anything without equity.

What I mean by that is a property could have a loan being foreclosed on for $200,000. The property could only be worth $210,000. It’s probably not worth pursuing this lead as there is no equity to be had unless this loan is on the back end of it’s amortization schedule.

Remember, in the foreclosure posting, the ORIGINAL loan balance is listed as well as the date of when it originated. So in this example above, the loan stated is $200,000, property is worth $210,000 but if the loan only as 2 years left on its 30 year mortgage. This means that the property actually has a ton of equity and is worth diving into.

The foreclosure notices also list the original loan document, which specifies the terms of the mortgage, which you can then reverse engineer the estimated equity of the property. At that point you can guesstimate where the starting bid will come in at.

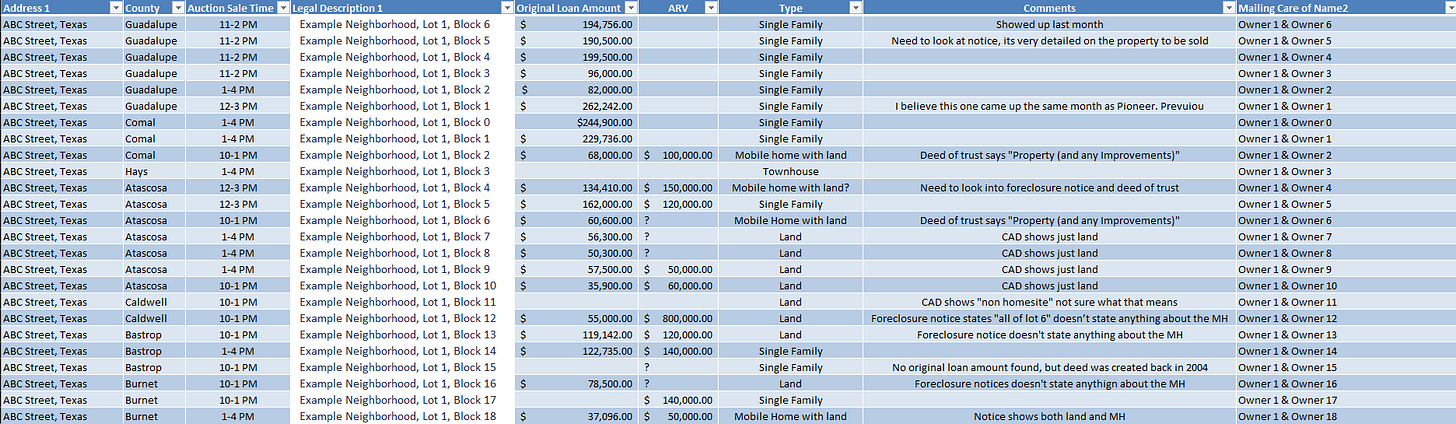

I found an old excel file for the month we were bidding on this deal. Not everything was filled out in its entirety but gives you an idea of what I was looking for when going to the auction. I was missing the equity or the estimated loan balance on this sheet, everything else is accounted for. I also sanitized this list of personal data.

Driving for Dollars

You weeded out all the underwater properties and cultivated a smaller list of homes to bid on. The next step is to drive by them. Remember, these homes are not owned by banks or associated with a real estate agent (typically). You can’t walk up and ask to see the inside (well you can, but tell me how that goes). Going on the property without the owners permission is trespassing! The best thing you can do is drive by the place, and also drive the area to look at comps and the like.

Driving by the home can tell you a lot about the property in itself. First thing I look for, is there a car parked out front? When buying at the auction, everything is bought “as-is” including potential occupants whether it’s the owner or previous tenants.

The second thing I lookout for is the roof and just the overall exterior condition of the home. Is it well kept? Is someone cutting the grass? Broken windows? You have to figure in the worst case scenario when purchasing properties sight unseen but a quick look around will help give a better idea of rehab.

The final thing I do, is to knock on the neighbors door. They will probably have a better scoop of the situation than anyone. Is it vacant, how long has it been vacant, does anyone take care of the property, is the owner alive, what’s the owner’s situation, etc…

Here are some of the pictures we got of the place. Seemed to be in good shape, surrounding area was not cut for a while, assumed it was vacant. That means not having to factor in an eviction. With the exterior in decent shape, also don’t have to factor in much rehab on that end.

I typically put a dropbox folder together of every property on the list, take exterior pictures of each home and the neighborhood. File it away under each properties respective folder, I also include the public tax data, foreclosure listing notice, original loan documents, and comps. That way I can access each property’s data quickly from my phone. You never know, the owner of the property might be present and is willing to strike a deal on the spot, got to have all your ducks in a row to present an offer!

The Short List

Now you’ve got pictures of all the properties to bid on, you weed out the ones that may have to much work involved, or the deal may be to skinny after factoring in a eviction. The list gets a little smaller. The next step is to see if the property is even going to hit the auction block. There are a variety of reasons for a property to be pulled from auction such as:

Owner already sold the home.

A loan modification was done, or a refinance.

A shortsale was started, which can postpone the date.

A TRO or some sort of legal filing was taken place, which can postpone a foreclosure

The owner files bankruptcy

The bank just decides to pull the file

Notice was given to the trustee of the owner being deceased, the bank must postpone once given written notice

Owner does a deed in lieu

Those are the ones I can think of, off the top of my head. A majority of the properties you see scheduled to go to auction, never actually make it there in the end. Just the name of the game. What you can do to confirm, is to call the trustee listed in the notice. It’s typically a attorney’s office. Good luck getting a hold of someone in a timely fashion.

I reserve this close to the tail end of underwriting instead of the start. It happens where you are three weeks out of the auction date, and you call the trustee and they state it’s still heading for the auction date. That doesn’t mean it won’t be removed the next week.

Now we’ve come to the end, one week away from Texas Tuesday, you scrubbed the list of underwater homes, drove by all the houses, called the trustees to make sure it’s still on the scheduled and now you have to do a title check.

The final underwriting you should probably do, is to get a title report or do a title search on the property. This will tell if there are any other liens on the home that you may want to know about like IRS tax liens, junior liens, judgements, etc…

Have to know what you buying when heading to the auction. If you are bidding on a HOA lien, you may think you are getting a steal but if there is a first mortgage in place, you are inheriting that debt with the property. Most people think of foreclosures as first mortgages but not all foreclosures are first liens. You have HOA, private money mortgages, second/third/fourth(!) liens. If you are purchasing a junior lien, you are taking it subject to all the liens above it.

For example, you want to bid on a home with a $100k first mortgage and a $20k second. The loan going into foreclosure is the second lien, not the first. You can bid on the 20k, win it at auction but you are still responsible for keeping the first lien at 100k current and paid for.

What happens when you bid on a first mortgage, with a second? Any junior positions are wiped out at foreclosure. Also, IRS liens TYPICALLY get wiped out as well. The trustee of the loan should give notice to the IRS ahead of the foreclosure, its up to you to call up to verify.

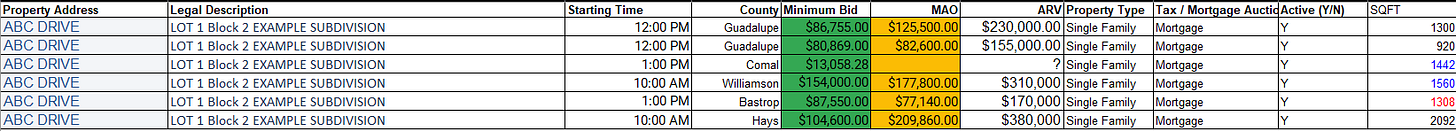

This was the final list after weeding out all the other deals. Our minimum bid that we estimated which is essentially what we think is owed on the property, I could’ve worded it as “estimated opening bid” as well. MAO means “max allowable offer”, the top end of what we should bid on each deal. Looking back at this old excel file, I am missing the trustee column. It’s good to know who’s actually auctioning off the property when at the steps.

Part 2 I’ll breakdown what happens on the day of the auction, getting into the property, and the actual figures of flipping this mobile home.

A Dose of AI

Keywords - Fred Flintstone, Hyper-realism, House