Bought a Property with a 0% Loan and No Money Out of Pocket!

A great creative financing deal that I just finished up selling. Bought it from the seller with a 0% loan and a piggy back second. Resold via seller finance, sold the note with no seasoning.

I got a good one for you guys. Another mobile home project with creative financing both on the purchase and the resale.

Acquiring The Deal

This one took a minute to close. Initially this deal came off a cold call from one of my virtual assistants. The owner of the property was extremely difficult to work with as she was hard of hearing and never returned calls or text. It took a number of trips to personally door knock and get her to sit down and sign a contract.

The contract to purchase was done in April of 2023 after months of back and forth. The purchase price at the time for the property was $75,000. It was in great shape and was a easy turn around rehab. Contract was submitted to title and we were looking to close it within 60 days. 60 Days turned to 90 days, then the seller kept falling in and out of touch. She wanted us us to close on a moments notice out of the blue, then disappeared for weeks.

To get a hold of the seller, I found her daughter’s address and knocked on her door and also mailed them a letter explaining the situation. From having the daughter talk to the seller, I was able to finally get the deal back. I had to do a final inspection before closing as it had been months since I last walked it.

This became an big issue as the property was now in an entirely different condition than when I put it under contract. The roof was completely shot, the house was stuffed with so much trash that it was next to impossible to walk through.

The video above is after we did a complete trash out of the place. At this point I had to renegotiate the price before closing. My new price was $40,000 down from $75,000. The seller did initially agree to it but just before signing the amendment, she wanted more money. So I pitched the idea of having her carry the balance and pay her $50,000 in 12 months after I flip the property. Basically instead of having to go to a hard money or private party lender and pay all the extra fees, I would have her be my lender instead.

Creative Financing - The Numbers

We want back and forth and the final loan terms we agreed to was:

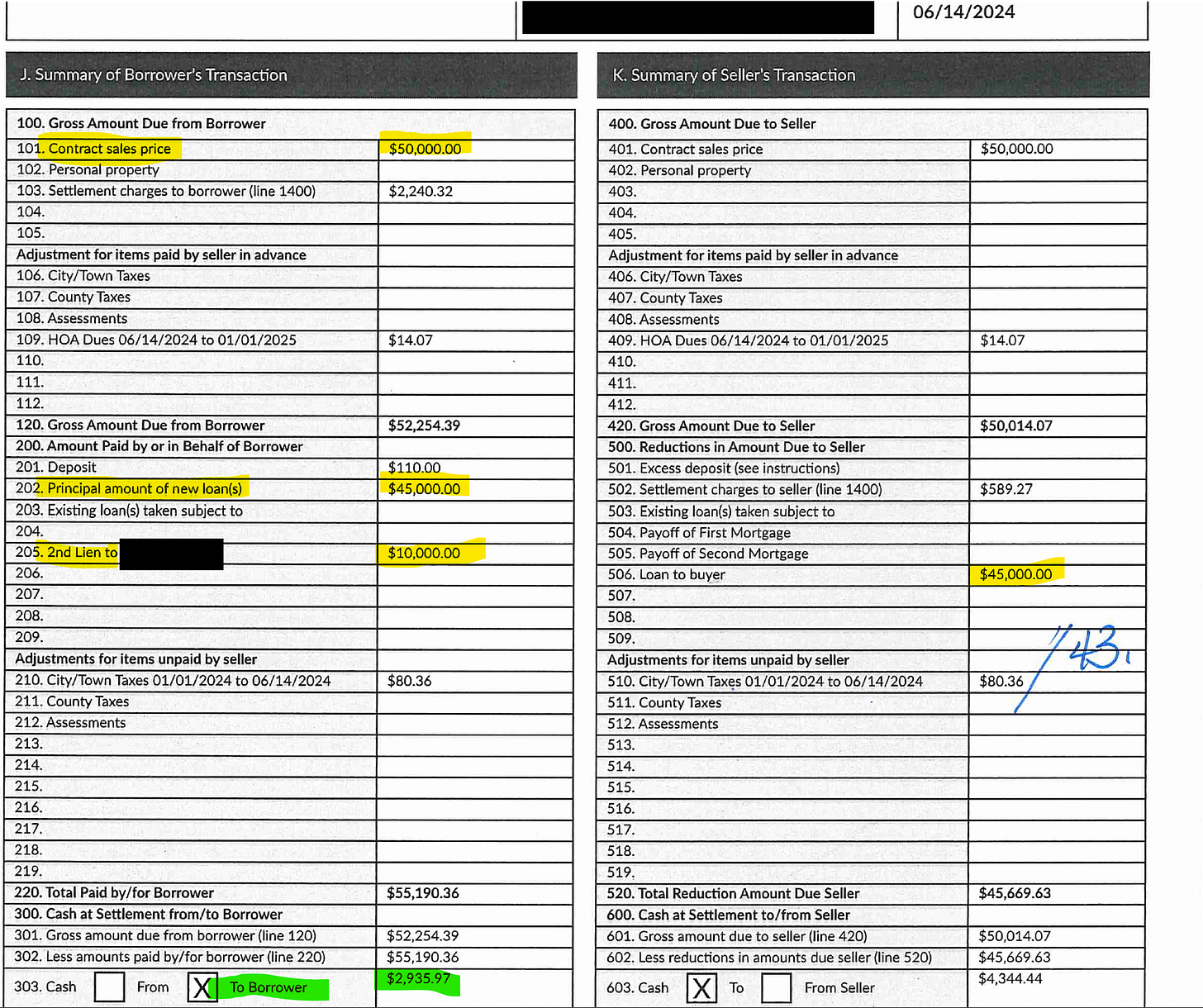

Purchase Price: $50,000.00

Down Payment: $5,000.00

Loan Amount: $45,000.00

Loan Terms: No monthly payments, 5 month balloon, first lien position.

Interest Rate: 0%

I would have to come up with $5,000 to close this plus closing costs, which is about $2,000 give or take. To make this happen I structured a piggy back second loan. Essentially I found a private money lender that was willing to lend me the money on a second lien position for the down payment, closing costs and a little bit of rehab monies.

For borrowing $10,000, I gave my lender an 18% APR, 5 month balloon, zero payments, second lien position. I had title draft up all the loan docs for both loans and scheduled closing.

As you can see from above, the two loan ares shown on the closing statement. I actually received money back at closing, I brought nothing to the table. The deal was completely funded with no money out of my pocket. I now have 5 months to get this thing resold.

“Prehab” and “Wholetailing”

After finding out that the roof was shot and leaking throughout the place, I switched how I viewed selling this home. I did not want to deal with a complete rehab as I busy with other rehabs. The resale of the property is probably closer to $200k.

A purchase of 50k, rehab of 70k, leaves a gross profit of around 80k. There is definitely a good chuck of change I’m giving up but I also have to weigh out the time I’m spending on managing this thing.

What a lot of investors do in this place is called prehabbing or wholetailing a deal. Prehabbing is when you just clean up a home and make it look more presentable to a end buyer who is looking for something at a discount and is willing to put in some sweat equity. Wholetailing is the strategy of closing on a fixer upper, “prehabbing” the deal, then listing it as-is on the market for a quick buck. It’s different than assigning a contract before closing, as you typically take ownership of the property when wholetailing. Closing on the deal allows you to list it online which opens up a larger pool of retail buyers instead of selling to investors.

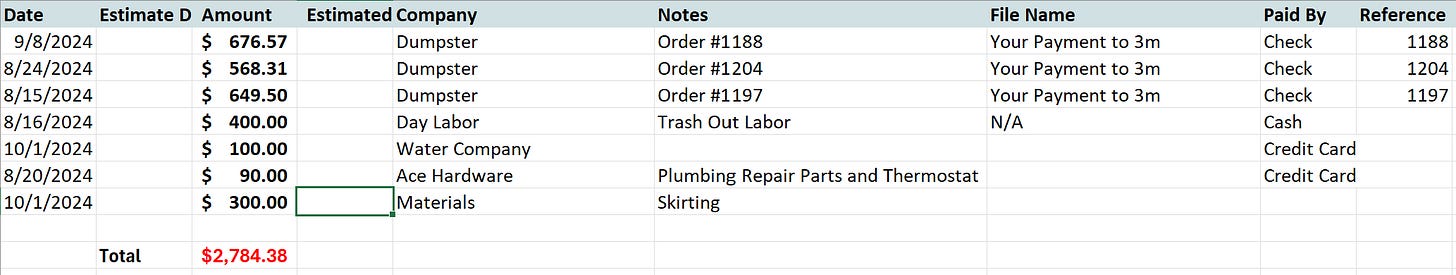

For this project, we filled up three 20 yard dumpsters to clean up the interior and some of the yard. We cut back the trees up on the roof, which were the cause of all the leaks. Cleaned up the back yard. A few plumbing leaks were fixed and that was it. Came in right at budget.

Here are the final images for resale.

Creating and Selling The Note

I put this on the MLS at $115,000.00. Got a number of investor offers out the gates from 25k to 50k. Took some time to find a buyer with a couple of price reductions. In the end, I found a buyer off facebook. Within walking it once, the buyer was ready to sign the contract. The gentlemen was a contractor himself and had the cash to close but preferred to keep some of it in reserves to complete renovations of the property. Here is what I pitched and he agreed to:

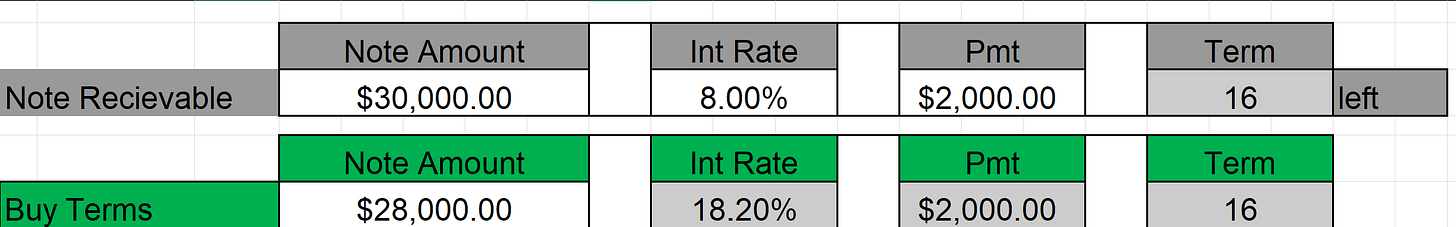

Purchase Price: $90,000

Down Payment: $60,000

Note: $30,000 First Lien

Rate: 8% rate

Term: 16 months

Payment: $2,000

Buyer had no issue closing outside of title to save on closing costs, so I handled the pro-ration of taxes, transfer of the HOA docs and recording of the Note, Deed, Deed of Trust and lien releases. From contract to closing it took about 5 days.

I used the 60k to pay off the first and second lien. I now have a paid off property and a 30k note at 8%. Instead of waiting 16 months to get my money back, I pitched this to my note buyers. Within 2 weeks, I resold this 30k note at 28k.

As you can see, I’m giving up about 2k of principal and 2k of interest on the full loan. I’m giving up $4,000 of profit for getting my money upfront. The investor buying the note at 28k is receiving a return of 18%+ on his capital. Not only that, the loan is secured against a property that’s worth 90k as of today to 200k once fixed up.

I’m currently finishing up a rehab not to far from this project so my hands have been tied. It’s another mobile home deal that I may flip or do a “wrap” on the loan. I took the property “subject to” the first mortgage from the seller at 4.5% interest. so this is another great project to utilize creating financing on the resale. I also have a Houston project that’s structured similar to this one I laid out, the seller agreed to finance his home at 0% for $800 down for 15 years. One way or another, I’ll do a case study on “wrapping” a loan.