50% Return in less than 6 months - House Flip in San Antonio, TX

A case study on a standard fix and flip home utilizing "hard money" lending. Detailing how I put a home under contract for only $110 down and closing on it with less than $6,500 out of pocket.

When attempting to find real estate deals there are a variety of ways of marketing to sellers from cold calling, sending mailers, offering on the MLS, and even door knocking. All of these take quite a bit of effort with a very low success rate (single digit percentages). In my experience, the best way to get a deal is through your network, the relationships you build around you. For this deal, I actually got this deal from the lender who funded the transaction.

This isn’t your convetional type of lender for home loans, most flippers utilize this type of commericial lending which is called “hard money”. If you were ever home buying and attempted to buy a home with mulitple offers and the agent responded that most of them are cash offers from investors. Cash, in the real estate business, actually means hard money. It’s kind of understood. It’s considered cash in the fact that this type of lending can close extremely quick, with very minimal underwriting guidelines which is typically just an appraisal, with no inspection or repairs needed.

Terms for hard money typically range from 8-14% interest rate (interest only monthly payments), 12 month term with a balloon (full payment due at end of term), and a couple origination points upfront. The intent for these loans is to be in and out of them quickly. Most will lend anywhere from 80-90% of the purchase price, or 70% of the ARV (after repair value) which can include a rehab account. This is crucial on how I was able to close with minimal out of pocket on this property.

Everything is Negotiable

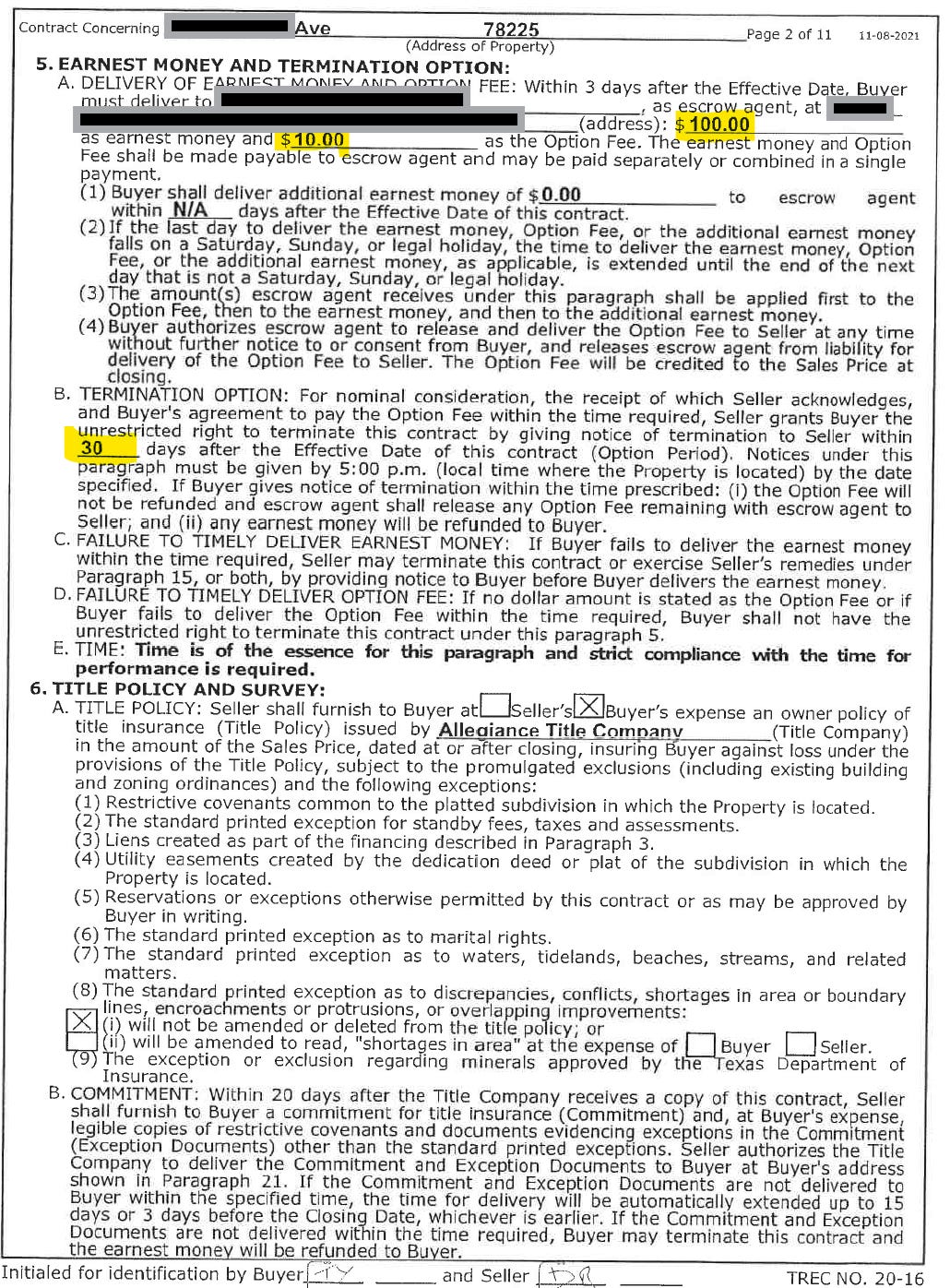

If you have ever purchased a home with an agent, there are these rules or standard practices put in place. For example, deposits should be 1% of the purchase price, the seller should pay for the title policy, buyer should have access to inspect the property, etc…. Lots of real estate agents do not want to steer away from these practices and are adamanat about having their clients stick to those terms.

Wrapping your head around the fact that every single thing on that real estate contract is negotiable can drastically increase favorable terms to you as the buyer.

In this case, the seller was motivated to sell as this property was inherited and the owner needed money as well as plenty of time to move out. The seller could care less about how much money I put down and was not set in stone on a specific close date.

The only times I’ve ever had push back from a seller about deposit amounts had an agent involved in the transaction. For $10 I got 30 days of inspection and for $100 in deposit I locked up this deal for 60 days to close.

The rest of the transaction was straight forward as we performed our inspection, had an appraisal done on the property and did a small extension to grant seller more time to move out.

There was an issue I had to sort through with this seller which is typical for most deals when the owner is still living in the property. Having cash on hand and extra time to move out is an issue especially when the seller doesn’t have the resources to do so.

To make this deal happen the seller requested $3,500 before closing to be able to afford the move. The money was used to secure a lease for another property and a deposit for movers.

To secure ourselves, we created a second lien that would be recorded if the property did not close. This would minimize the risk we had out on the deal. The $3,500 would be credited towards the price at closing.

Lastly, the seller requested some time after closing to make sure they would have everything removed from the property in time. In this case we structured a lease to be in place, with $10,000 of seller proceeds to be held back at closing and charging them $30 a day. Once the seller was completely vacated of the property, we would release the last of their monies minus the per diem.

Closing, Rehab and Resale

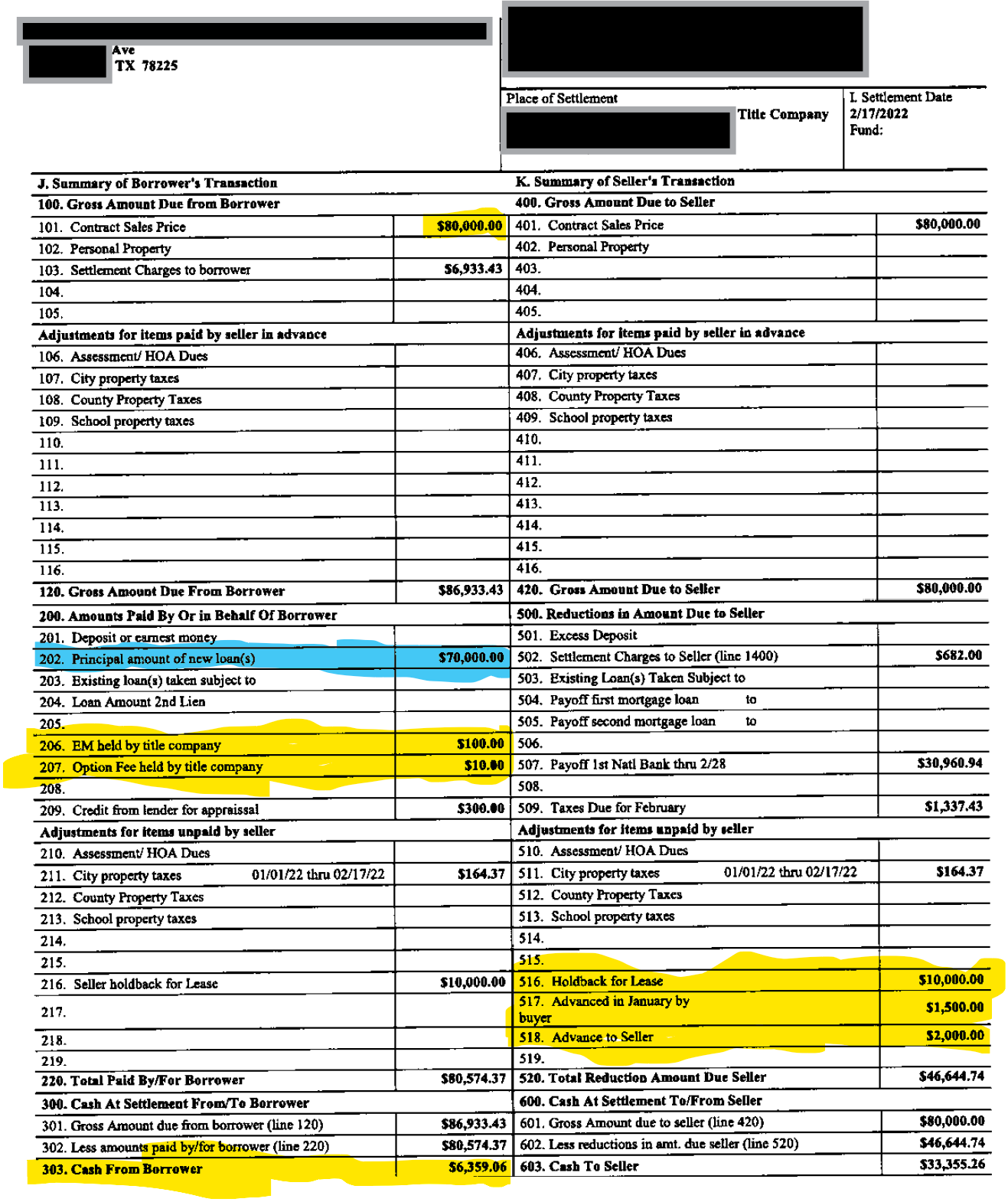

No surprises on closing day, and the seller moved out within a couple weeks. The closing statement is below showing my cash to close.

The cash to close for this deal is listed at the bottom, the deposits and credits for the advances are also broken out above. I did secure a loan which is highlighted in blue for $70,000. My purchase price was $80,000 so I’m out the difference plus closing costs. Since this is a purchase only loan, I have to fund my rehab out my own pocket. Despite only needing $6,359.06 to close, plus the advances to the seller, I would still need to have reserves for my rehab and interest payments to the loan. There are loan products that do include renovation budgets as part of the loan amount, I did not elect for that in this case.

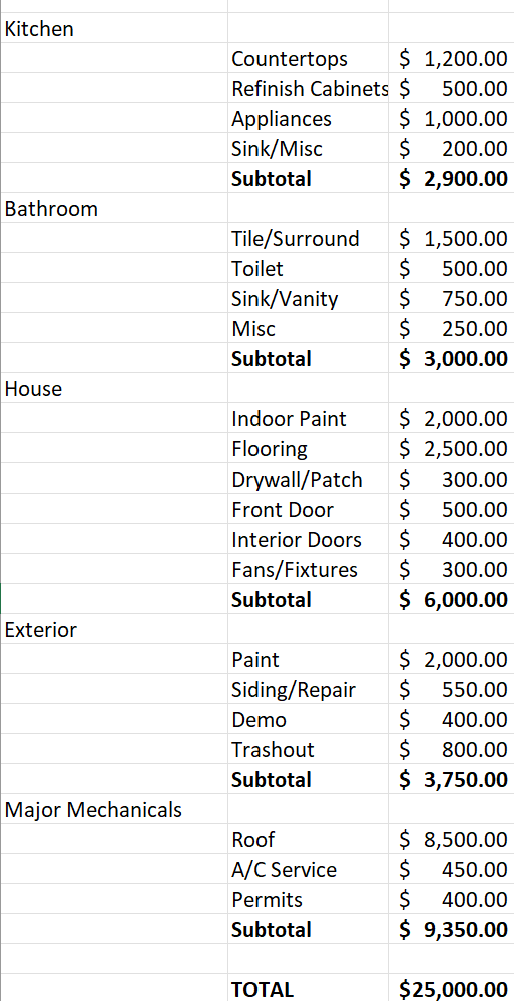

This is the rehab budget that I had to put together and submit to the lender. In the end the rehab came in a little lower and some of the items listed above were not needed, but just like every rehab, other renovation issues popped up and funds were used to cover those expenses. It evened out in the end.

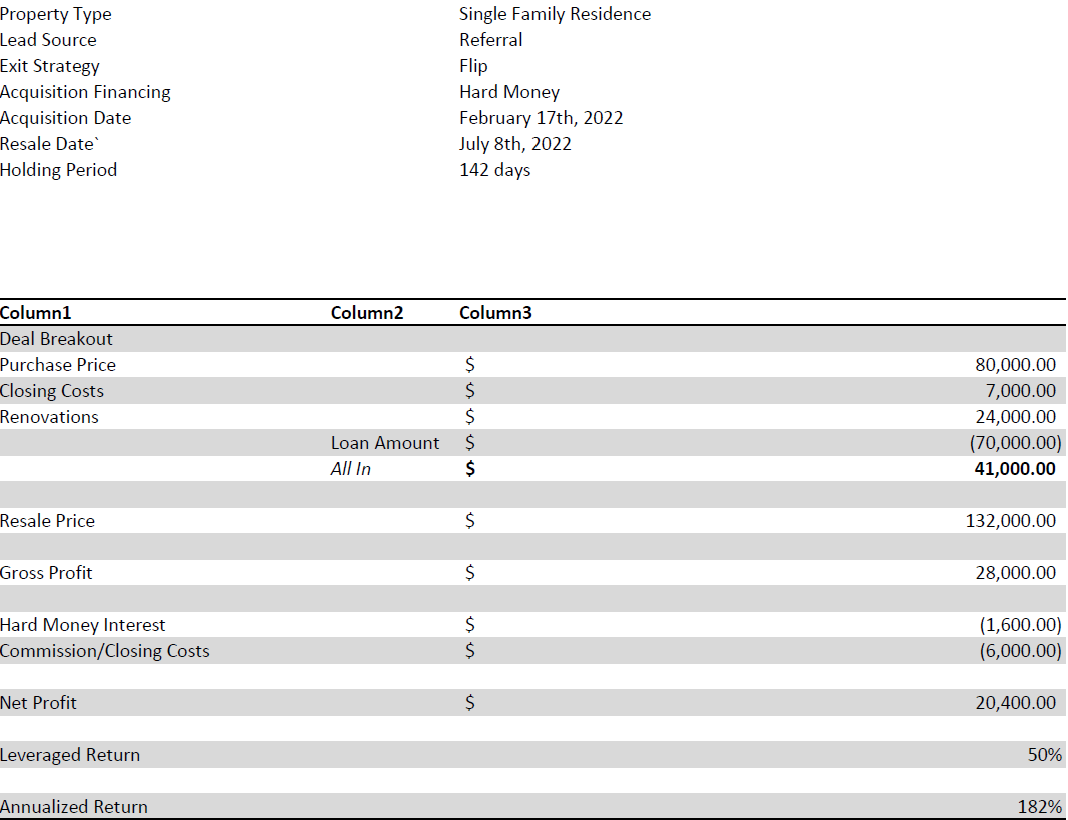

Got this thing turned around fairly quickly and listed on the market. It fell in and out of contract 4 times. Locked in a buyer at $132,000, all cash with zero concessions except paying for title. All in all a decent real estate deal, final numbers are below. Utilizing leverage, the return on this deal was north of 50%. Rounded up figures to make it easier to read.

For the next case study, it’ll be an land deal that we are almost done selling off. It started as a land purchase we got off zillow for $10,000 and got 50% of our money back shortly after closing by selling off a small portion of the land to a neighbor. You don’t need big bucks to do land development.

A Dose of AI

Prompts - American Football on the moon