$10,000 for 9 Lots - Zillow Land Development Deal - Part 1

Here is a case study on a deal sourced straight from Zillow. This is a active deal, as we are still selling off the last 2 lots at the time of this posting.

A few things to note here, we did put this project on the back burner for a while. We used our own cash to purchase it so we were not in a big rush to turn this thing around. You’ll notice closing statements spanning back to 2021. Only recently have we been listing these lots and selling them off.

Covid, Real Estate, and Warren Buffet

Travel back in time with me to the first quarter of 2021. Covid was just starting to hit the United States. We all experienced the social distancing, market turmoil and the like. I want to go back and recap what it looked like from working at a larger real estate investment operation and how it all circles back to buying this piece of land for cheap.

At the time, I was working at a real estate investment company that operated all over California. I was overseeing the wholesaling division. Anything the company didn’t want to purchase outright to flip or put into their rental porfolio, my team would flip the contracts to other buyers.

One morning when we were still coming into the office, I was told to wholesale everything we had on the board. We were not looking to take down anything at this time. It struck me kind of odd as the company as a whole was extremely well capitalized to purchase these outright and weather the storm. All of the deals had a lot of equity built in as well. The overall sentiment of the market was unknown so a ton of our buyers were on pause to purchase anything further. That same week I learned of a large lender pausing all commercial lending which also spooked a lot of local investors.

It was fairly difficult to find active buyers at the time to pick up our deals, even at discounted prices. Our team in the end found a few investors who could absolutely care less about the current Covid market conditions, and we did sell most these properties to them at a extreme discount. I’m talking 40% of market on some of them.

The reason for this story is this, despite working at a real estate investment firm that had a large warchest at it’s disposal, in the middle of a market crisis where real estate was almost at its lowest point in years, the company decides to sell off all of its deals (in the short term) instead of closing on them. It reminds me of the Warren Buffet quote:

“Be fearful when others are greedy, and be greedy when others are fearful."

In this moment, the few investors who closed on those deals we had, made an absolute killing once the market started turning. They bought as close to the bottom of the real estate market as you could. I recall checking property values on these deals about 9 months later, and they could’ve easily sold these deals for a 80-120k profit as is. Mind you these deals were mostly under $200k purchase price.

What’s the point of this story? Two things.

We bought this piece of land close to the bottom of the market during Covid. Took a risk, but it’s hard to lose on buying 9 lots at $10,000.00 with road frontage and utility access. I was working in California and this piece of property is located in the middle of nowhere Texas. Never even drove by the place.

Also, history doesn’t repeat but it rhymes. The Fed has recently lowered rates a half a point. History shows that a slowdown follows when rates start coming down. If/When the market starts turning south, it’s not a sign of the world is ending, it should be a sign as everything is going on sale.

Underwriting Land - What To Look For

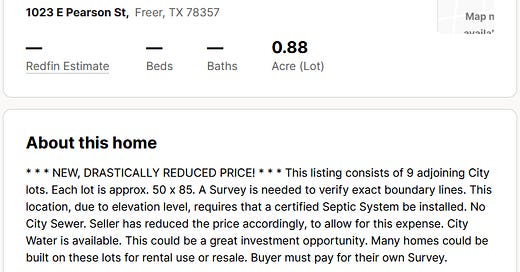

Did my best to try to find the old zillow listing but with everything being syndicated to other sites, you can see the info from the pictures above. Price was slowly being reduced until we just jumped on it at $10k. You can see it via the zillow picture. I find it funny one site is valuing this property over $100k, goes to show those numbers can be way off on estimating value.

When looking at land, a few big items to make note of:

Road Frontage

Utility Access/Availability - Sewer or Septic/Water/Electricity

Easements

Zoning

You can see just buy the position of this lot that it was located within a subdivision on a standard road. We confirmed it had city water and access to put in electrical. There was no sewer at that portion of the street so we did have to factor in extending a sewer line nearby to service the lots. All this information can be gathered through talking to your local city or county office.

Anytime when you’re closing on vacant land, you’ll want to get a survey. All in all it was about $12k to close this deal. Being our own broker, we did save $600 in commissions applied to the deal. 10k for the land, 2k for the survey.

Buy the barrel, sell by the bottle

Land development takes time, you can’t go out there with a backhoe and start working on the place. Permits and utilty hook ups take time.

During that time we talked to the owner adjancent to the right most piece of our property. He had a shed that encroached on our property. We immediately struck a deal with him and sold him that portion of land for 5k cash. No title company involved to eat up closing costs, just a cashier’s check exchanged for a deed. Don’t have a closing statement to show but contract is below.

Per the city to install sewer lines to our lots we had to pay for a pump on top of the line install. The reason we were told was the road was at a slope enough to justify needing a pump. All in all it costed us $10k and the lot at the very left end of our property got a free sewer hook up courtesy of us.

We also threw up 2 electrical meters on two of the lots, which ran about $4,000 each.

I’ll end the write up here. In part 2 I’ll break out the full excel sheet showing the costs we incurred for each lot and the profit on each sale. I’ll also dive into mobile home / chattle loan land sales. We plan on marketing one of our last two lots as a land home package.

“$99,000 3 bed / 2 bath - Brand New Mobile Home /w Land”

There is a way to make housing affordable. I’ll dive into the numbers in the next post.

Been reading your posts. I chatted with you a few weeks back on Reddit. I love the seller financed mobile home deal. Awesome investing.